11 Investment Tips for People in Tech

If you work in tech, you’re a unique individual. If you live in a tech hub like the Bay Area, Austin, or Silicon Slopes, being a working tech professional may seem like the norm, but it’s not.

Most online investment tips and advice are catered to the masses, people who are close to retirement, or simply meant as clickbait. This article is meant to provide you with investment tips and teach you how to invest in a way that’s optimized for someone working in tech.

Tip #1 - Understand why investing is crucial to living how you want to live

Albert Einstein famously said, “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t pays it.”

We all have dreams of becoming financially independent and living life on our terms. We all have different preferences for what we want to achieve in life. The cold hard truth is that investing, and investing often, will help you achieve what you want in life. The sooner you begin investing, the sooner you’ll have compound interest working for you.

Before you even begin investing, you want to begin with the end in mind. Think about what’s important to you about money and how you choose to use it. One of our favorite books to help with this process is Carl Richards’s book “One-page Financial Plan.”

You don’t have to have a perfect plan for your entire life, but you want to ensure you’re prioritizing what’s important.

Once you have a general sense of your “why,” it’ll be time to learn about how important compound interest is going to be for you as you progress in a tech career.

To increase your wealth, setting aside some percentage of your pay every month or every paycheck will have a huge effect on how much money you’ll have in 10, 15, 20 years+.

Here’s a link to NerdWallet’s Compound Interest Calculator.

For fun, we recommend plugging in different amounts to get a sense of the sum you’d like to save for. The calculator forces you to start with a $100 initial investment, but you can change the contribution amounts and frequency.

For the return, it’s safer to assume a 7% to 8% return if you’re aggressive and a 5% to 6% return if you’re being less aggressive. Historically, you might have been able to see double digit returns every year, but the current reality dictates that we should be a little more conservative when projecting our investment accounts in the future. (This is something Instagram and TikTok financial gurus don’t do!)

Tip #2 - You can get 90% of the return you want with very little effort

When investing in U.S. companies, 92% of investment professionals haven’t been able to outperform the simple strategy of holding an S&P 500 index fund.

Two things you’ll need to know to understand the importance of that sentence above.

The S&P 500 tracks the performance of the largest 500 companies in the U.S.

An index fund is an investment that enables you to invest in lots of different companies all at once.

Therefore, an S&P 500 index fund is a way to invest in the largest 500 companies in the U.S. all at once.

This doesn’t mean that you own an equal piece of all 500 companies. Index funds weight companies differently. For example, companies like Apple and Microsoft are weighted more than others. (Learn more about how companies are weighted here).

So if 92% of investment professionals can’t beat the performance of an S&P 500 index, why would you even try buying and selling stocks on your own?

These investment professionals spend well over 40 hours per week scouring potential investment opportunities. If you work in tech, you’re spending 40+ hours doing a job that’s probably not related to finding investment opportunities in the U.S. Even if you were to start putting loads of time into selecting investments, at best, you’d still only have an 8% chance of beating the simple buy and hold strategy over the long-run.

Your time is better spent investing in low-cost index funds or ETFs for the vast majority of your portfolio. If you still want to buy individual stocks because you like the company, we strongly encourage you to do so, but that piece of your portfolio shouldn’t be causing you to spend hours a day doing research.

One of our favorite books for learning the basics of investing is “The Bogleheads' Guide to the Three-Fund Portfolio.” This book teaches you how to create a portfolio of three funds that will likely outperform most investment managers.

Tip #2.5 - Investment Allocation Recommendations for Tech Professionals

When people talk about their investment allocation, they are talking about what investments they’ve purchased, how much they’ve purchased, and why it’s a good fit for them. Each different category of investment is called an asset class.

Talking about investment allocation and asset classes is a lot like talking about a homemade salsa recipe. There are certain key ingredients (asset classes) every salsa needs to have and there are some ingredients that will totally depend on who’s making the salsa (the investment allocation).

I may love adding triple the amount of jalapeños to a recipe, but not everyone is into that. I may always want to hold 20% of a portfolio in a single stock position, but others might not want to be that invested in one company.

The perfect investment allocation, like the perfect salsa recipe, will depend on you and your unique situation.

Next to the asset class, we’ve listed 2 investments that you can purchase to invest within that asset class. We’ve stuck with Vanguard’s options for the majority of the investments, but Charles Schwab and Fidelity each have great, comparable options.

U.S. Stock:

Large-cap (Valued at $10b+) - VFIAX or VOO

Mid-cap (Valued between $2b-$10b) - VIMAX or VO

Small-cap (Valued below $2b) - VSMAX or VB

All U.S. market caps in one - VTSAX or VTI

Typically, U.S. stock holdings will be largest weighting in a portfolio if you’re seeking long-term growth. (Please note these are merely tickers of options, they are not specific recommendations.)

Developed International Stock (Canada, Germany, the U.K., Australia, Japan, etc.)

Developed International - VTMGX or VEA

Emerging Markets Allocation (Brazil, China, Mexico, Chile, etc.)

Emerging Markets - VEMAX or VWO

Alternatives (Real Estate, Utilities, Commodities, Gold, etc.)

Real Estate - VGSLX or VNQ

Utilities - VUIAX or VPU

Commodities - VCMDX

Materials - VMIAX or VAW

Gold - GLD or IAU

Bonds

The bond piece of the allocation really depends on your goals but should be a vital part of your portfolio as your progress in your career. That said, here are some taxable bond funds that could be good options:

VBILX or MWTIX

Tip #3 - The “don’t put all your eggs in one basket” saying is mostly true

People in tech hear this phrase all the time as they’re being advised by someone to sell their company stock. We’ve even written an article providing some help to determine how much is too much.

You don’t want your financial hopes and dreams to be 100% reliant on the performance of any one company. If one company makes up a significant part of your wealth, that can be fine, but you need to be aware of how much you’re risking by heavily investing in that one company.

If you’re at a tech company that is growing like crazy and you’re receiving options that might be valuable someday, we often recommend taking advantage of options early to get large tax breaks later. That said, you shouldn’t put in money that you aren’t okay losing.

Tip #4 - Utilize all elements of your 401(k)

Tech companies typically offer their employees great investment benefits. Most tech companies’ 401(k)s include some very valuable elements that techies often under-appreciate. Here are a few common examples:

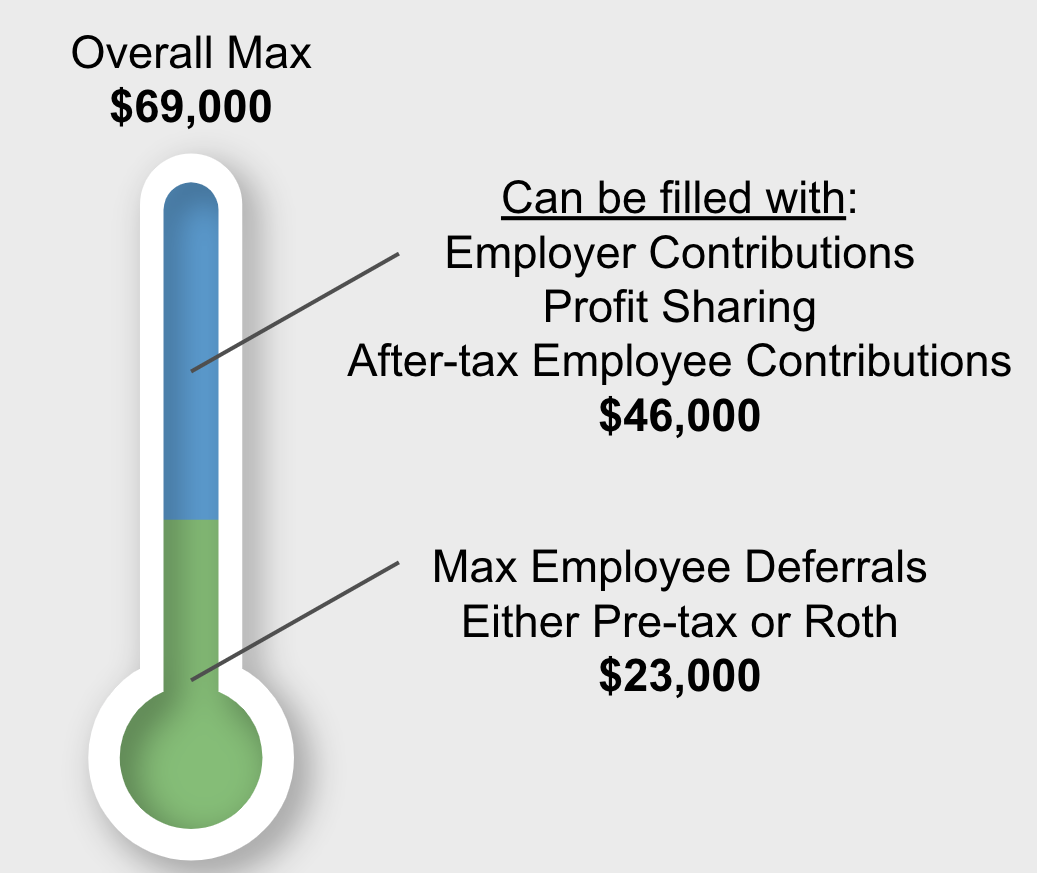

Deferrals - Max of $23,000 for 2024

Pre-tax Deferral - This is the standard way to contribute to your 401(k). You avoid paying taxes, and money goes into your 401(k) to be invested. Someday when you withdraw from the 401(k) you’ll have to pay taxes on everything you pull out.

Roth Deferral - A Roth deferral is a contribution to your 401(k), but before you put money in, you pay taxes on everything that goes in. The big benefit is that someday when you pull money out, you won’t owe taxes on what you contributed or on the growth of the investments.

Other contributions

The combined limit between Deferrals and Other contributions is very nice $69,000 in 2024. To determine the amount that is available for other contributions, you have to subtract out the deferrals you’ve put in and the amount that your employer has put in to see how much of the combined limit you have left. So if you maxed out your 401(k) deferrals, you’d take $69,000 - $23,000 leaving you with $46,000 that can go into your 401(k) from other sources.

After-tax contributions - Works similarly to the Roth bucket, but the growth will be taxed when you pull the funds out.

Automatic Roth conversions - Lets you convert After-tax contributions to the Roth categorization automatically. This enables those contributions to then be pulled tax-free later in life.

Now that you’ve read a rundown of the elements within your 401(k), we recommend maxing the 401(k) out whenever it’s doable given your cash flow. One big thing to note is that if your company does not have a 401(k) true-up provision, you could end up missing employer match money.

After maxing out your 401(k), we recommend taking advantage of Automatic Roth conversions if it’s an option within your 401(k). If your employer doesn’t offer it, you may want to prioritize regular taxable investments instead.

Tip #5 - Max out your ESPP

If your employer offers an ESPP and there’s a discount, we highly recommend putting the maximum you can into it. Depending on the company, we typically recommend selling shortly after purchase to ensure you lock in the discount you’re receiving.

We’ve written articles describing how much to contribute to your ESPP, how great Adobe’s ESPP is, and when to sell ESPP shares.

ESPPs are a great way to build wealth, so we’ve written quite a bit about them.

Tip #6 - Put high-growth assets in your Roth bucket

If you’ve followed through on some of the tips above, you’ve probably managed to get assets in the Roth bucket of investment assets.

Given that Roth assets can be withdrawn tax-free, it makes a lot of sense to invest those assets into assets that have higher growth potential over the long term.

Typically within your 401(k), you’re able to select investments specific to each type of contribution (pre-tax, Roth, after-tax). We recommend reviewing this and putting your Roth assets in funds that are weighted more towards stock than bonds.

Tip #7 - Be careful of duplicate investments within your investments

If you work for a large tech company (like Apple, Amazon, Google, Microsoft, Nvidia, etc.), the investments that we’ve suggested and most of the investments within your 401(k) likely already hold a significant stake in those specific companies. So if you’re investing in one of those companies on your own, through your ESPP or through grants of RSUs, it’s important to keep track of just how much you have invested in each company.

Tip #8 - Keep beneficiaries up to date

This seems to be an obvious one, but you should double-check to make sure the beneficiaries on all of your accounts are up to date.

This is important because if you were to die, your assets will go to whomever is listed as the beneficiary. If you don’t have a beneficiary, your assets will be subject to probate, which means that state courts will determine how your account will be divided up.

Tip #9 - Stop watching financial news

CNBC, MadMoney, and funny memes on WSB are good sources of entertainment, but none of those outlets know your situation and are only trying to increase their viewership.

Watching these shows can be addictive and can cause you to second-guess your long-term investment strategy.

If you want to stress less, stop watching financial news networks and focus your efforts on improving yourself and those around you.

Tip #10 - Always be buying (A.B.B.)

This isn’t the most grammatically correct way to say it, but you should be buying more often than you’re selling.

One of our favorite services out there that’s free to use is M1 Finance they offer portfolios that match Boglehead philosophy but help you automate the buying process. They also have one of the best savings accounts for holding your emergency fund.

Markets are at highs far more often than they are at lows. Because of this, the timing of when you begin to invest or continue to invest doesn’t matter. If everything is probably going to be up in 10 years anyway, the important thing is that you start today. The common phrase that get repeated is “Time in the market is more important that timing the market.”

Tip #11 - Hire a Fiduciary Advisor

Most of you who are reading this article are DIYers and we love DIYers. However, at some point it’s probably wise to consult with a financial expert who will take the time to understand your unique situation.

There are a lot of crappy advisors out there, and there are even more who don’t understand the intricacies of equity compensation.

NAPFA has a good advisor search tool to help you find someone who will be a good fit.

If you’re interested in having us build out custom recommendations, please check out our services page and schedule a fit check.

Thank you for reading and if you have any questions, please feel free to reach out to us directly at team@equityftw.com.