ESPP Disqualifying Dispositions Explained

Employee Stock Purchase Plans (ESPPs) are best known for providing employees an easy way to accumulate shares of the company they work for. You can choose to keep those shares for the long-term or you can sell the shares quickly to lock in the discount you received at purchase.

Selling ESPP shares immediately or shortly after purchase results in what’s called a Disqualifying Disposition. It sounds like an unappealing way to sell your shares, but the reality is that selling ESPP shares through a disqualifying disposition is a fantastic strategy. It’s counter-intuitive, but sometimes ESPP Disqualifying Dispositions provide a better result than ESPP Qualifying Dispositions!

The purpose of this article is to provide you with a basic overview of ESPP Disqualifying Dispositions so that you can feel confident about utilizing the strategy.

What is an ESPP Disqualifying Disposition?

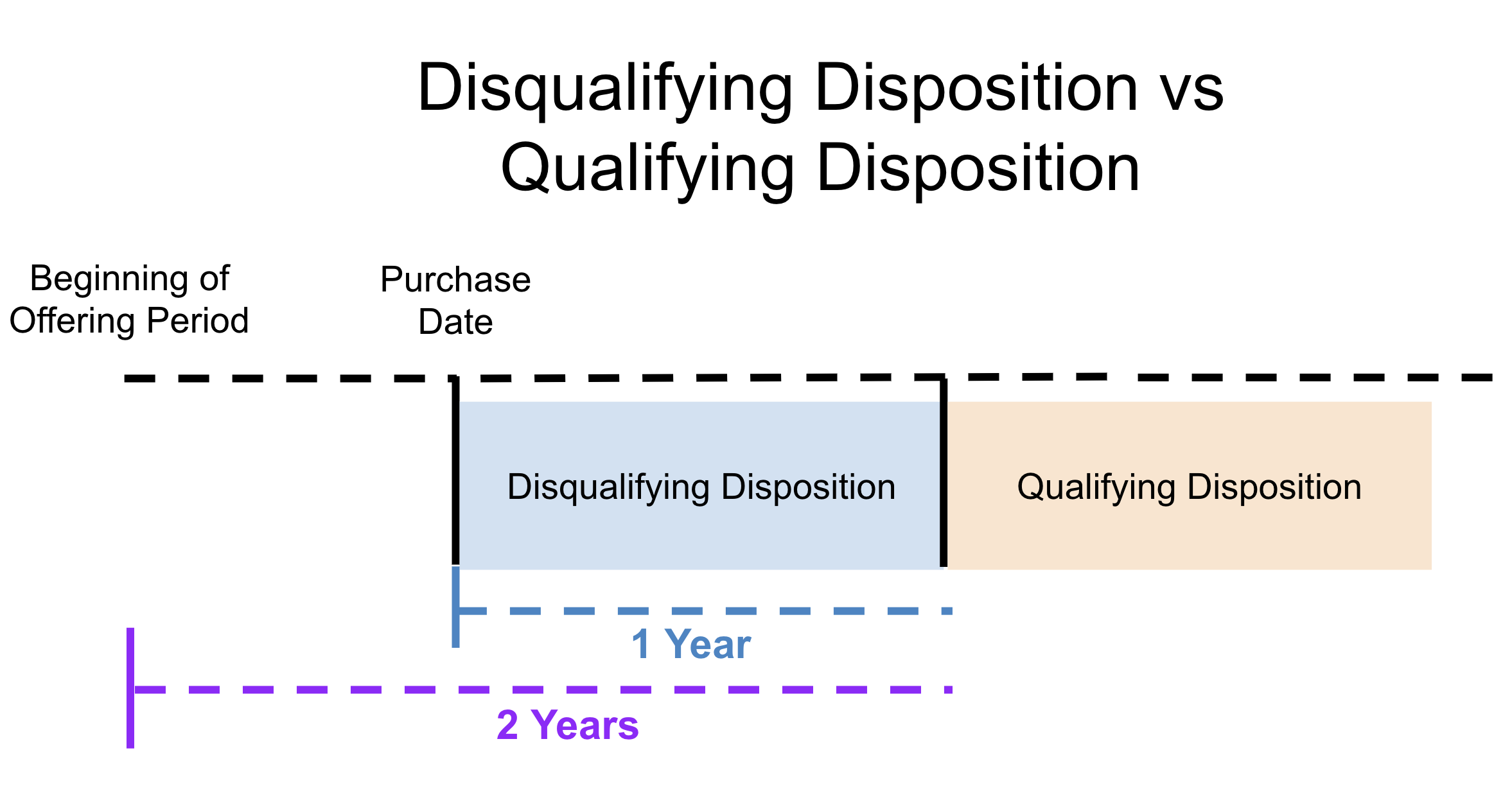

A Disqualifying Disposition occurs anytime you sell recently purchased ESPP shares:

Within one year of purchase

Within two years of the beginning of the ESPP offering period

Here’s a timeline depicting both an ESPP Disqualifying Disposition and an ESPP Qualifying Disposition.

As you can see from this illustration above, if you sell ESPP shares before waiting 1 year from your purchase and before waiting two years from the beginning of the offering period in which you purchased your shares, you’ll have yourself a Disqualifying Disposition. If you wait that requisite amount of time, you’ll have a Qualifying Disposition.

Why the Word “Disqualifying”?

There are IRS rules that enable your ESPP shares to (potentially) qualify for better tax treatment when you sell. (They’re the same rules described above, just replace the word “within” with “after.”)

If you meet this specific holding requirement, your sale of ESPP shares is considered qualified for (potentially) better tax treatment.

If you don’t meet that holding period requirement your disposition gets the scary “disqualifying” label slapped on it because you’re no longer eligible for (potentially) better tax treatment.

As you can infer from our annoyingly repetitive use of “potentially,” Qualifying Dispositions are NOT always better than Disqualifying Dispositions. For as much FOMO as the word “disqualifying” may make you feel, that label should not influence the timing of your actions too heavily.

Two Types of ESPP Disqualifying Dispositions

To help you understand, let’s discuss Disqualifying Dispositions further.

There are two types of Disqualifying Dispositions (and you’ll want to remember these for later):

Disqualifying Dispositions with Short-term Capital Gains

Disqualifying Dispositions with Long-term Capital Gains

Generally, any investment you hold for longer than 365 days before eventually selling will qualify as Long-term Capital Gains (LTCGs).

Any investment you hold and sell for less than 365 days will qualify as Short Term Capital Gains (STCGs).

Can you now see how you can have two types of disqualifying dispositions?

Since disqualifying dispositions occur anytime you sell before the two year mark of the beginning of your ESPP’s offering period, there’s really a progression of disposition types.

Here’s a timeline showing both types of disqualifying dispositions.

Understanding these disposition types is something a bit more advanced than understanding just ESPP basics, but it’s knowledge that proves helpful as you try to make informed decisions about when to sell your ESPP shares.

With an understanding of the disposition types, we can now discuss why you would want a Disqualifying Disposition and show some numbers to back up that assertion.

Why Would You Want an ESPP Disqualifying Disposition?

We’ll start by saying this is a broad question that ultimately comes down to what’s going on in your life.

Here are most common reasons people opt for a Disqualifying Disposition vs Qualifying Disposition:

#1 - You want to lock in the discount you received.

Most ESPPs offer a discount of 15%, but it’s not uncommon to receive discounts even larger than this.

The question is, Why subject yourself to single stock fluctuations in price when you can sell and diversify to lock-in again?

Even if this scenario results in more taxes than a Qualified Disposition, it’s better to have a sure thing than to have to wait a year plus to sell.

#2 - You want to diversify your investment holdings.

If you’re enrolled in an ESPP it’s very possible you’re also receiving RSUs or other forms of equity.

ESPPs can be a great way to fund other investments if all you’re doing is contributing then selling shortly after purchase.

#3 - The tax break of waiting for a Qualifying Disposition isn’t worth the wait.

We’ll show an example in a minute, but sometimes it’s literally better to have a Disqualifying Disposition.

There are more reasons to do a Disqualifying Disposition than the three we’ve just explained above. In a previous article, we address in greater detail when you should sell ESPP shares and we highly recommend reading it.

When are Disqualifying Dispositions Better Than Qualifying Dispositions?

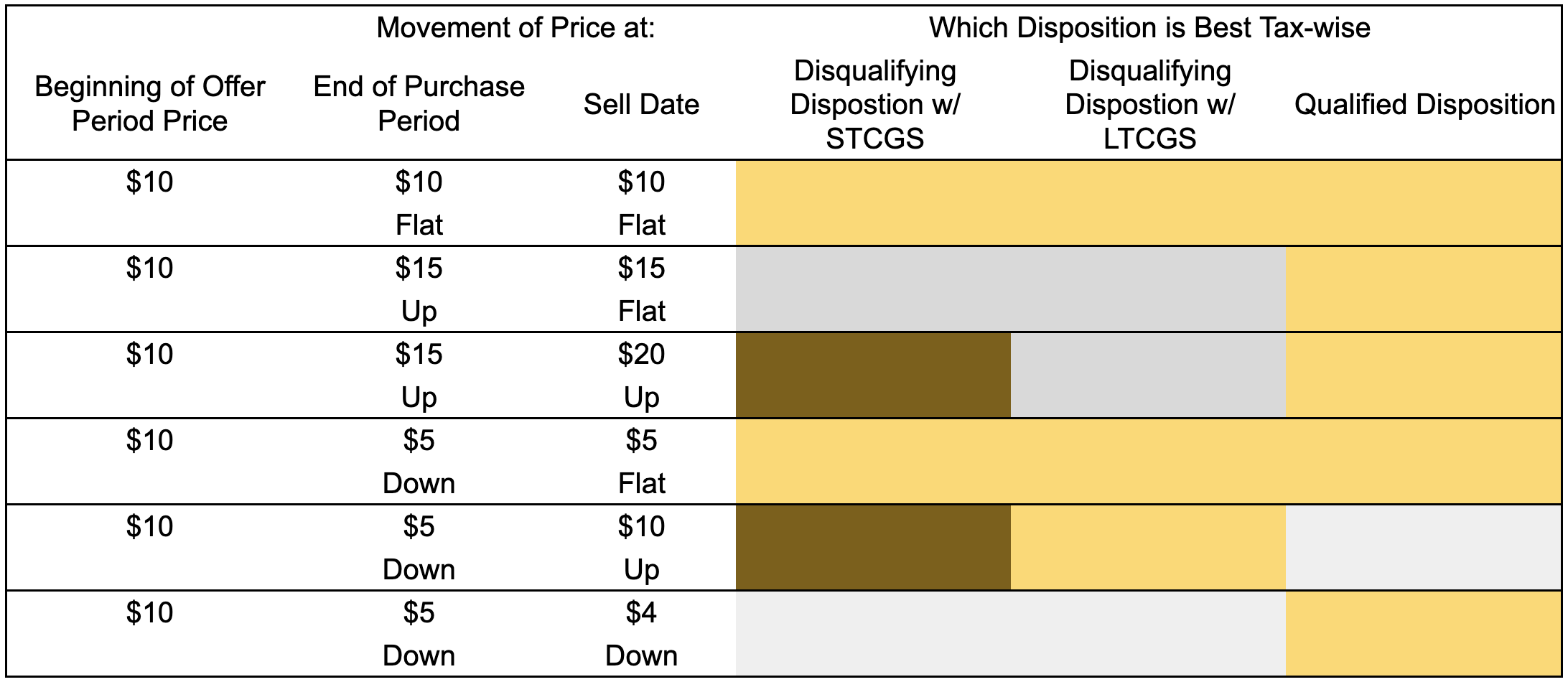

We’ll discuss the details of which disposition is better when, but broadly speaking, if you have an ESPP with a lookback provision, here’s how price movements relate to which Disposition type is better.

This might be our ugliest graphic ever, so here are the scenarios explained.

If the price stays flat the whole time, the disposition type doesn’t matter, all dispositions are the same tax-wise.

If the price goes up between the beginning of the ESPP Offering Period and when you purchase, then stays flat, Qualified Dispositions are the best tax-wise and Disqualified Dispositions are equal.

If the prices only goes up, it goes, Qualified Disposition, Disqualified Disposition with LTCGs, then Disqualified Disposition with STCGs.

If the stock price goes down from the beginning of the offering period to when you purchase the ESPP shares, then stays flat, all disposition types are the same tax-wise again.

If the stock price goes down then comes back up after purchase, Disqualified Dispositions with Long-term Capital gains will be better tax-wise.

In the sad scenario of the stock price going down, then down again, Qualified Dispositions can be best, but it’s often equal to the other disposition types. It ultimately depends on how much the stock price goes down each time.

After seeing all of these examples, you’re probably noticing that Qualified Dispositions are better tax-wise a lot of the time still. Yes that’s true, but the scenario where a Disqualified Disposition with LTCGs is best plays out all the time, so it’s important you’re aware.

You’re welcome to run some scenarios through our ESPP Gain and Tax Calculator so you can see the effect of each disposition type at work.

Final Thoughts on ESPP Disqualifying Dispositions

We are big fans of Disqualifying Dispositions. There aren’t many guarantees in life (other than death and taxes), so if you can lock in the 15% discount on ESPP shares and then move it into some other investment or make good use of the cash, that’s awesome.

Some people say you should only do Disqualifying Dispositions and that you should always sell immediately after purchase. We disagree. We don’t believe in using blanket language that doesn’t take into account the individual’s situation, desires, and risk tolerance.

Eventually we’ll build a tool to help you determine which Disposition type will be optimal given the current state of your holdings, but until then, the best thing you can do is to be intentional about how you’re investing through your ESPP and sell your shares when you feel best.

Thanks for reading. If you found this article helpful and are interested in having us speak at your company, please reach out to us.