How to Read an Employee Stock Purchase Plan (ESPP) Purchase Confirmation

We’re huge fans of employee stock purchase plans (ESPPs). We’ve published articles discussing the basics of ESPPs, how much to contribute to ESPPs, and and article discussing when you can sell your ESPP shares. In this article, we’re going to dissect how to read an ESPP purchase confirmation.

This may not sound like a very thrilling topic, but once you learn how to read these confirmations it’ll make you more excited about participating in your ESPP. And as an added bonus, you get to be the awesome person who can help your coworkers understand it and score points with them.

Sample ESPP Purchase Confirmation

Below you’ll find a sample ESPP purchase confirmation. We’ve also provided the whole document/PDF for download here. Typically you’ll join the ESPP, set aside money with each paycheck, then purchase the shares at the end of the specified purchase period. This confirmation or something like it will be generated anytime you purchase company shares through your company-sponsored ESPP and it’s meant to communicate all the relevant details about the purchase.

This is a very broad view, so as we progress through each section of this article, we’ll zoom in on different sections to clarify. If you use ETRADE, your purchase confirmations should look almost identical to this one. Morgan Stanley, Carta, and Charles Schwab should all have similar confirmations so even if it looks slightly different, it’ll help teach you what you need to know.

Basic Information - The Very Top

This section of the ESPP probably doesn’t need much explanation, but it’s important to make sure your personal information is correct. Verifying this information is also important because if you don’t have electronic delivery set up on your account, tax documents will get mailed to the address on file.

ESPP “Purchase Summary” - Left Columns

Account Number - This references the specific account where your cash is set aside every paycheck and where your company shares are eventually purchased.

Company Name (Symbol) - This is, as you probably guessed, the name of your company. The symbol is a series of letters that represents your company in the stock market. Here are some examples, Apple = AAPL, Adobe = ADBE, Amazon = AMZN, Microsoft = MSFT, McDonald’s = MCD, Walmart = WMT, Nike = NKE, ServiceNow = NOW, etc. You can look up your company on Yahoo Finance using your company symbol/ticker.

Plan - Some companies have different plans based on the stock they offer employees, this line is just for tracking where company shares are being issued from (not that vital to you).

Grant Date - This date represents the beginning of your company’s offering period and is extremely important to be aware of. The offering period is the period in which purchase periods are offered (you can get a quick refresher by reading our ESPP Basics article.

Some companies allow employees to purchase company shares at a lower price between the beginning of the offering period, or the actual date of purchase (timing varies based on the company).

Purchase Begin Date - This date is important because it marks the first day you began setting aside money from your paycheck to eventually purchase ESPP shares on the Purchase Date, aka the end of the purchase period.

Purchase Date - This is the day all of the cash you’ve been setting aside is used to purchase company shares. You can compare this date to the Purchase Begin Date to determine how long your company’s Purchase Period is.

In this example, you can also see that the Grant Date is equal to the Purchase Begin Date. This means that the employee is at the beginning of the offering period, which can be up to 27 months, so you will want to check within your company plan documents to see exactly how long the Offering Period really is.

ESPP “Purchase Summary” - “Shares Purchased to Date in the Current Offering”

Beginning Balance - This shows how many ESPP shares you owned within the ESPP at the beginning of this Purchase Period. In this case, it is 0 shares.

Shares Purchased - This shows the total number of shares that you purchased through the ESPP during this Purchase Period. We’ll get to the calculation of the actual purchases here in a second.

Total Shares Purchased for Offering - This will be the total amount of ESPP shares that you purchase during the Offering Period. Since this is the first time in this example we’ve had a purchase, it will equal the Shares Purchased above.

Shares Deposited in STREETNAME to E*TRADE Securities LLC - This one is a bit odd, but it basically means the number of shares E*TRADE (or whatever company) is holding your ESPP shares for you.

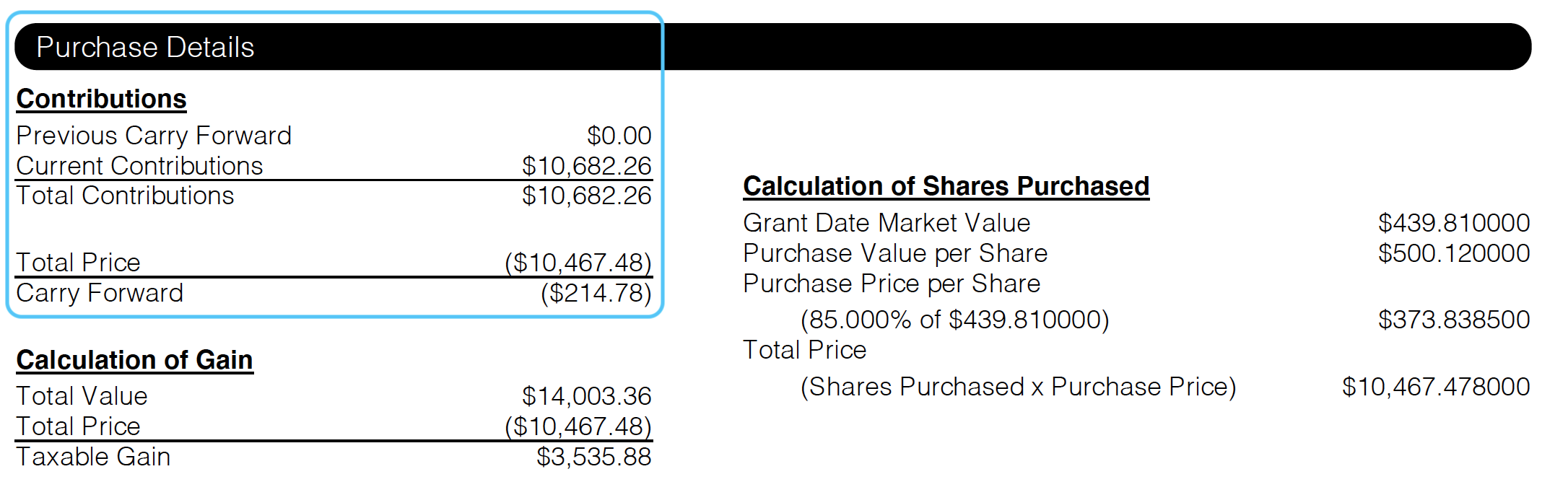

ESPP “Purchase Details” - Contributions

Previous Carry Forward - In this example, it equals $0; however, if there is money remaining after a previous ESPP purchase, some of the leftover cash can carry forward to the next Purchase Period. This happens because it’s not very often that the money you’ve saved up will equally be divided in whole company shares.

Current Contributions - This shows the total amount of money that has been saved within your ESPP during the Purchase Period.

Total Contributions - This number is the sum of the Previous Carry Forward amount and the Current Contributions amount.

Total Price - This is the amount of money that went towards the purchase of company ESPP shares. You’ll notice immediately that the total is slightly less than the Total Contributions.

Carry Forward - This is the remaining amount after purchasing company shares. Since the ESPP shares couldn’t evenly be purchased with the amount that was saved up, the remaining balance will be carried forward through the Offering Period, into the next Purchase Period.

ESPP “Contributions Details” All Columns

These columns show the details of each time money went from your paycheck to your ESPP. The two most important columns to look at are the Contribution Date and Contribution Amount columns. You may have even amounts or you may have differing amounts as in this example. If you’re depositing different amounts each paycheck, it may be due to the variable part of your pay (for example, commissions).

ESPP “Purchase Details” - “Calculation of Shares Purchased”

This section will show us the math behind how our ESPP shares were purchased and it will provide Market Values at different points in time.

Grant Date Market Value - This is the price that your company was trading for on the stock market at the beginning of the Offering Period. This is an important number to know because if your company’s ESPP offers a lookback and the price has gone up over the last few months, you’ll be able to have the ESPP discount applied to this price for the length of the Offering Period! We’ve described some of these calculations in our ESPP basics article, which we’ve linked twice already, but here it is again.

Purchase Value per Shares - This is the Market Price of your company at the end of the Purchase Period/Purchase Date. As you can see, the price has increased about $60 a share since the beginning of the Offering Period.

Purchase Price per Share - Since this company’s ESPP offers a lookback, it looks at both the $500.12 number and the $439.81 number, then chooses the lesser of the two. (Pay attention here.) The ESPP then applies the 15% discount to the lower number ($439.81) and let’s you purchase shares at that price. So to easily illustrate this, the Purchase Price per Share shows the calculation, then provides the discounted ESPP Purchase Price per Share of $373.8385. If you’re not excited about this, you should be!

Total Price - There are some behind the scenes calculations going on here, but this section shows the total dollar amount of discounted shares you can purchase through your ESPP.

ESPP “Purchase Details” - “Calculation of Gain”

This section shows the amount of gain you’ve received from purchased company shares through your ESPP. It won’t calculate the taxes for you, but it makes it easy for you to see the massive value ESPPs can provide.

Total Value - This is the total number of shares that you purchased, multiplied by the current market price. It doesn’t show the math, but it’s taking 28 company shares times the market price on the purchase date, $500.12, to get $14,003.36.

Total Price - This is the total amount you spent to purchase company shares. It’s the same number from the Calculation of Shares Purchased.

Taxable Gain - You can think of this number as your ESPP profit. By contributing $10,467.48 to your ESPP, you were able to buy $14,003.36 of company stock. To determine your percentage gain, you’ll take $3,535.88 divided by $10,467.48 to get a gain of 33.78%! Even though the discount is only 15%, the gains are actually much higher due to the lookback at the lower price.

Another important note here: You will not owe taxes for purchasing ESPP shares until after you have sold the shares. The tax consequences will vary based on how long you hold the shares before you sell. We’ve built a simple ESPP gain and tax calculator that’s free to use. You’re welcome to check it out.

Conclusion on How to Read an ESPP Purchase Confirmation

Employee stock purchase plans are an absolute must-use in terms of savings. Sometimes people are a little intimidated by them, especially if this is their first time purchasing stock of any kind. Now that you’ve read this article and this ESPP Purchase Confirmation, you should feel much more confident when sifting through your company’s ESPP documents.

As always, please feel free to reach out with any questions. Thank you for reading and we hope you’ll subscribe if you found the content helpful.