Making the Most of Super Micro Computer (SMCI) RSUs

Super Micro Computers’ (SMCI) RSUs went from being a nice employee perk to making many employees millionaires. SMCI’s steep increase in price is only rivaled by Nvidia and, percentage-wise, SMCI is the winner over the last four years.

When RSU packages start with a value of $20k to 30k and quickly become worth over $400k, it’s worth spending some time learning what things you should consider doing to best manage your RSUs.

With so many employees holding SMCI RSUs, we wanted to do a deep dive into how employees can manage their SMCI RSUs effectively.

If you’re an employee at SMCI holding SMCI RSUs, you’ll want to understand:

Key Terms Related to Your SMCI RSUs

How SMCI RSUs are taxed

Whether or not you should sell SMCI RSUs at vest

What to do if you never sold SMCI RSUs

This article should help you with all of these things. And if you still have questions, please reach out to us at team@equityftw.com.

SMCI RSU Key terms

Before we begin a more detailed discussion of managing SMCI RSUs, we need to go over a few terms related to RSUs. We’ve compiled a list of important RSU terms to know and discuss all of these in our RSU basics articles. We invite you to read both if you’d like.

Grant date - is the date on which you receive your grant of SMCI RSUs

Vesting Schedule - is the timeline under which SMCI RSUs will be released to you and officially become SMCI shares that you own outright. SMCI offers a 4-year vesting schedule with 25% vesting each year, but they have provided other vesting schedules in the past as well so it can vary from person to person.

Vested/Unvested - details which SMCI RSUs have already been released to you vs still need to meet the vesting requirements. If you quit with unvested RSUs, you will likely forfeit them all.

Vest Date - is the date on which your SMCI RSUs are released to you

Ordinary Income - is the type of income that RSUs cause when they vest

Tax Withholding - as SMCI RSUs vest, SMCI will set aside a portion of the vested amount for taxes (we’ll discuss this more in the next section).

Now that we’ve reviewed some of the basic terms, let’s jump into a discussion about tax treatment.

How SMCI RSUs are Taxed

SMCI RSUs are typically taxed at two points in time.

At vest

At sale

At vest, your RSUs are treated as wages and get taxed as ordinary income.

At sale, your RSUs are taxed as capital gains or treated as capital losses.

Since RSUs are taxed at vest, it doesn’t matter what the RSUs were worth back when they were first granted. All that matters is the value of your RSUs at vest.

This means that if you received 10,000 SMCI RSUs that vested at $40, you’d have taxable income of $400,000 on the day those SMCI RSUs vested. It doesn’t matter if the stock price rises or falls after that point, the taxes are calculated based on the value at vest.

SMCI RSU Tax Withholding

Companies which offer employees RSUs have a requirement to withhold from those RSUs as they vest to ensure that taxes are paid.

If you make less than $1M, companies usually withhold 22%

If you make more than $1M, companies usually withhold 37%

This is extremely important if you have SMCI RSUs because if you make more than $150k, there is a high likelihood that you’re not setting aside enough money for taxes as your SMCI RSUs vest.

For example, if you have $400k worth of RSUs vest, you might only have 22% withheld for taxes. Depending on your salary, your actual tax rate is probably 32% or 35%. This means that you’ve likely underwithheld and may be surprised by a $40k+ tax bill for not withholding enough!

Adjust Tax Return for After Selling SMCI RSUs

While we’re discussing how SMCI RSUs are taxed, it’s worth mentioning that you’ll want to pay especially close attention to how you complete your taxes in any year you sell RSUs.

When RSUs vest and become fully taxable, you are considered to have a “cost basis” that matches that fully taxable amount. The problem is that the brokerage where your vested RSUs/shares are held likely does not properly reflect this.

This means that if you aren’t careful when completing your tax return, you could easily end up mistakenly paying taxes twice on RSUs.

Should You Sell SMCI RSUs or Shares?

Because each individual has a different financial situation, different preferences, different outlooks on SMCI, and different amounts of SMCI equity, this complicates giving specific recommendations about what should be done with SMCI RSUs.

We also understand that “It depends” is a thoroughly unsatisfying answer. So to help you, we’ll go through a few important considerations to give you some direction.

Evaluate Your Current Financial Situation Objectively

Since SMCI RSUs have gone from being worth a little to a lot in a few short years, some of you may now find yourselves with enough wealth to provide for the rest of your life and maybe the lives of your children and grandchildren.

The first step in determining what to do with your SMCI RSUs is to think about the financial goals you’d like to accomplish.

Here are some some important questions to ask yourself:

Do you have debts that you need to pay off?

Are you currently saving for anything in particular?

How much SMCI is already vested vs what are you expecting to receive?

How much SMCI equity is too much for you?

Do you have other investments?

Does SMCI make up the majority of your net worth?

How will you feel if you miss out on X dollar amount of gain?

How will you feel if SMCI drops by 50%?

This list may not cover all of the questions worth considering, but we hope you find it helpful as you think about what you should do.

If you’re sitting on a couple million dollars or more, you’ll likely want to consult a professional to get their objective advice.

How Much SMCI Stock is Too Much?

After evaluating your financial situation, you’ll want to revisit the question, “How much company stock is too much?” And after you’ve done that, you’ll want to formulate an action plan going forward.

Working for a company that’s experienced huge growth can be great financially, but you do need to remain cautious about how much of your future you’re staking on that company.

If you’ve been working at SMCI for a while, it’s likely that you have SMCI RSUs, SMCI Nonqualified Stock Options (NSOs), and maybe even SMCI Incentive Stock Options (ISOs). In addition to all of this equity, your paycheck and other employee benefits are also likely tied to the company.

Being concentrated in one stock or company can help create wealth, but at a certain point you should begin thinking about preserving your wealth. If you can ensure your lifetime expenses are covered by selling a portion of SMCI RSUs, it’s worth strategizing how much and when to sell.

Even CEO Charles Liang sold about 13 million dollars worth of shares in 2024 and the CFO David Weigand sold about 5 million dollars worth of SMCI as well. This doesn’t necessarily mean that leadership thinks the company is going to go down, but it does illustrate that even the higher-ups use their own profits to ensure that their financial goals are met.

SMCI RSU Selling Strategies

It might feel weird to sell something that’s gone up so much in value, but that’s what makes SMCI RSUs a potentially good option to sell. Assuming selling SMCI it’s what’s best for you, there are a few simple selling strategies that you can follow to remove some of the emotion from the decision to sell.

Sell everything at vest.

Selling all RSUs at vest is the most commonly recommended strategy for four reasons:

(1) RSUs are fully taxable at vest, so there’s no immediate tax benefit for deciding to hold.

(2) Selling immediately ensures you have enough money set aside for taxes.

(3) Selling provides cash to reinvest elsewhere or to use for personal goals.

(4) You will still be able to participate in the growth of the company through RSUs that haven’t vested yet and through whatever RSUs you haven’t previously sold.

Selling all your RSUs at vest is a move towards diversification. It’s leaning into the fact that you can’t guess what will happen in the future and that it may be a wiser move to extract some value from your equity.

One problem with selling RSUs right away is that it’s not always possible due to the trading windows. So by saying “Sell everything at vest,” it is really more like saying, “Sell everything that is vested as soon as you’re able to.”

SMCI’s stock price could easily go up more after you sell, but taking some risk off the table is often a great decision.

Target X% of net worth to keep.

This strategy requires a little bit more thought and attention, but is a great strategy if you want to put in the effort.

With this strategy, you will designate some target percentage of your net worth for you SMCI holdings to make up. We typically like to look at liquid net worth vs your entire net worth, but it’s totally up to you.

Depending on the stock price movement of SMCI, this could mean you keep RSUs as they vest of it means you sell. Regardless, it’s a strategy that will evolve based on how SMCI grows and how your own investments grow.

Sell 80% at vest.

Selling the vast majority of RSUs at vest is a strategy recommended by many advisors because it gets you to a place in which you’re mostly diversified, but also leaves enough in the company that you can feel as though you’re continuing to participate in the growth of the company.

It’s important that before you move forward with the 80/20 ratio selling strategy, that you take into account all the other SMCI equity you might have in relation to your balance sheet. If you’re heavily weighted in SMCI equity, you may want to sell more aggressively at the start and then taper off to 80/20.

Sell half at vest.

Selling half of your RSUs when they vest can be a good move if you can afford the risk. It ensures that you have enough to cover taxes, provides extra cash for other needs, and leaves a lot of potential for upside. The downside is that you'll remain significantly exposed to your company's stock performance.

It’s important to run some stress tests to understand how a significant drop in stock price could impact your financial goals in the future.

Avoiding Taxes on Massive SMCI Gains

One of the things we see happen frequently is that people continue to hold RSUs after vest simply because it’s the easiest thing to do. Any action is harder than no action, so whether you intentionally or unintentionally have held onto your vested SMCI RSUs, you’re likely sitting on a large pile of SMCI stock that’s gone up in value.

Depending on the size of your gain, there are a few options at your disposal which can directly save some money on taxes should you choose to sell your SMCI holdings.

Donate SMCI Shares to a Charitable Organization

One of the easiest ways to avoid taxes is to donate money and/or stock to a qualified charitable organization. This can result in an immediate tax benefit, but it ultimately means that money goes to charity instead of you.

When you donate to a charitable organization, you can choose to donate cash or stock and whatever you contribute will count as an itemized deduction on your tax return in the year you made the donation.

It’s important to understand that there are some limits concerning charitable giving.

You only can deduct charitable contributions if your itemized deductions are higher than your standard deduction. Assuming you itemize, your contributions will offset your income on a 1-to-1 basis.

If you contribute stock, your deduction is limited to 30% of your Adjusted Gross Income (AGI).

If you contribute cash, your deduction is limited to 60% of your AGI.

If you go over those amounts, the excess will carry forward for up to 5 future tax years.

If you’re looking for an example, you have example in our how to avoid taxes on your RSUs article.

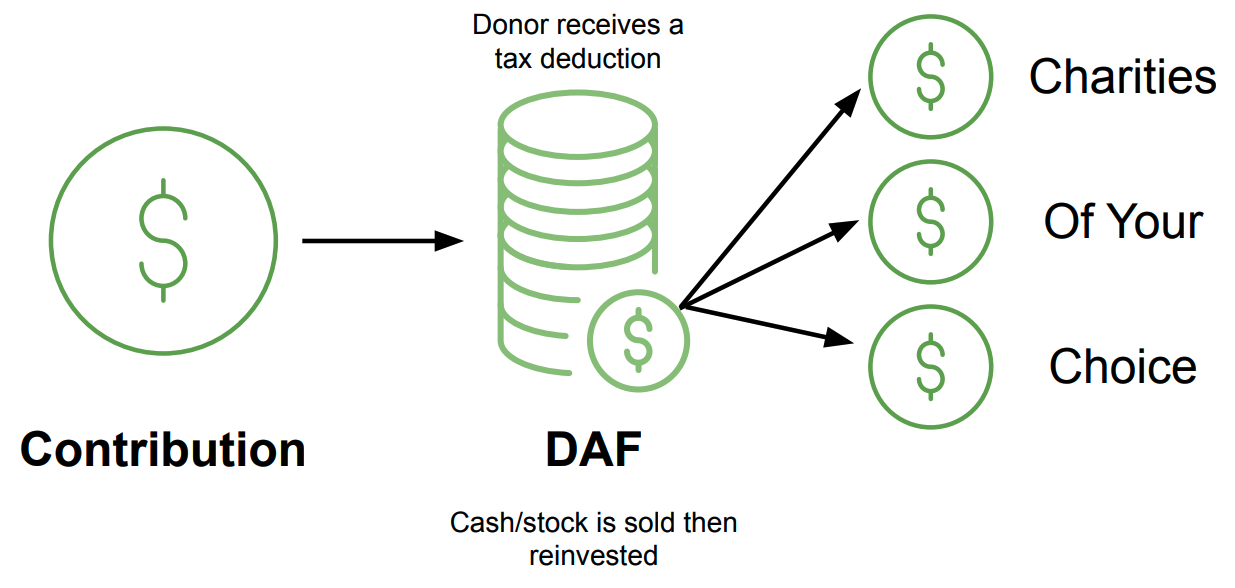

Create a Donor Advised Fund (DAF)

Another similar strategy to donating SMCI shares directly to charity is setting up a Donor Advised Fund (DAF).

A DAF is a charitable investment account where you contribute stock and receive a deduction. After contributing the stock, you can reinvest whatever you donated tax-free and then distribute money to charitable organizations over time.

Money that is contributed must be used for charity, but there is no set timeline.

Here’s an illustration to help with understanding.

We’ve covered DAFs and charitable contributions in greater detail in our article Using a DAF to Pay Tithing. Even if the tithing aspect doesn’t apply to you, everything else in the article will.

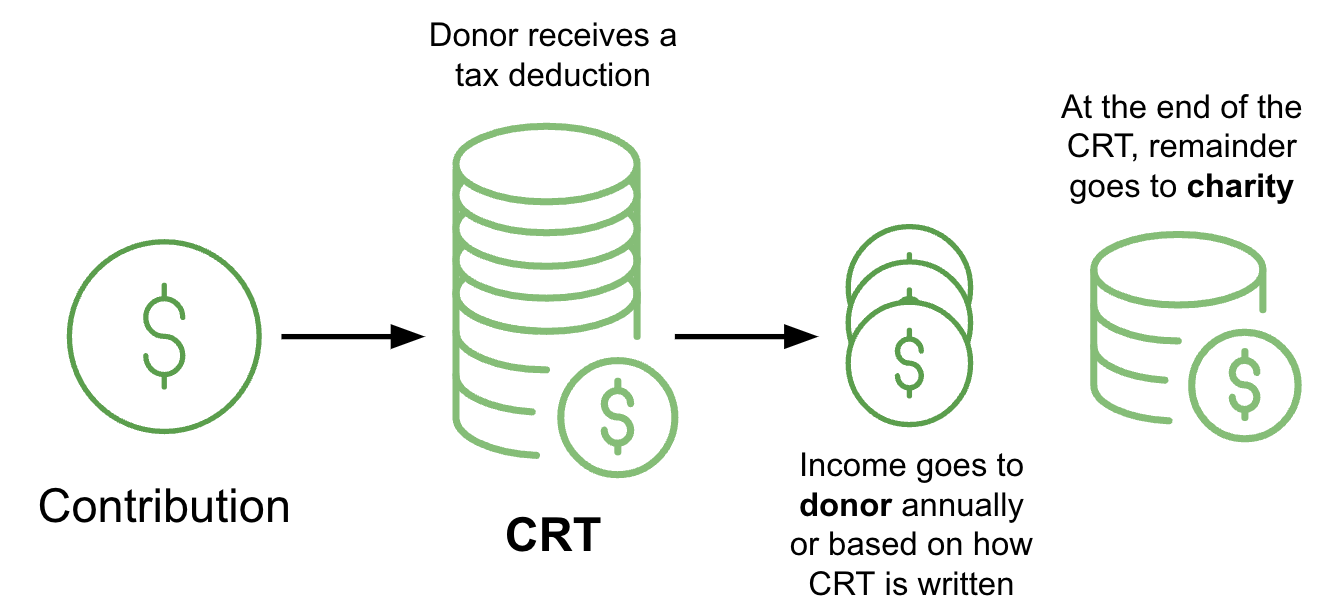

Establish a Charitable Remainder Trust (CRT)

There are a few different versions of a CRT, but they all allow for the donor of stock to still receive a benefit rather than having absolutely everything going to charity. To set one up you’ll need to work with an estate attorney. (You can’t just open these accounts up online).

Here’s a summary of how a CRT works:

You put stock into the CRT and

receive a deduction for whatever you contribute.

The stock within the CRT is then reinvested/diversified into other holdings.

The CRT distributes income to you for some length of time.

At the end of the CRT, the remainder goes to charity.

Here’s an illustration to help you visualize how they work.

The biggest difference between a CRT and other charitable giving strategies is that the CRT allows you to benefit from your charitable contribution rather than the entire thing going to charity.

It’s a great vehicle for those who want to avoid taxes on SMCI RSUs which have appreciated significantly, but it does add some complexity. It will probably cost a few thousand dollars to set up the CRT and a separate tax return will need to be filed annually for the CRT as well. Implementing a CRT strategy can be beneficial, but it really only makes sense if you’re contributing around $1M or more to the CRT.

Contribute SMCI Shares to an Exchange Fund

The last way you can avoid taxes on SMCI RSUs is to contribute the shares that have appreciated into an Exchange Fund.

An exchange fund is a collection of highly appreciated stocks from a group of investors. Each investor takes their highly-appreciated stock, contributes it to the fund, then in return, is given a slice of the fund which is made up of everyone’s highly-appreciated stock.

We’ve covered Exchange Funds in detail in our article When to Use an Exchange Fund. If you have $500k+ worth of SMCI gains, it's probably worth learning more about.

Final Thoughts on Managing SMCI RSUs

Managing SMCI RSUs is a unique challenge because not many companies ever experience this type of explosive growth.

As your account values grow, so does the impact of your financial decisions.

It’s important to remember that it’s impossible to perfectly optimize how you manage SMCI RSUs. You just have to make informed decisions based on what’s best for you and plan from there.

Managing your SMCI RSUs properly can provide you with a unique opportunity to set yourself up for financial success. It’s just up to you to make the most of it.

If you feel you need assistance with managing your SMCI RSUs, we advise clients on these topics all the time. You’re welcome to schedule a call.